Introduction:

In today’s globalized world, the need for efficient and cost-effective international money transfers is more significant than ever. Whether you’re sending money to family abroad, paying for goods and services, or managing your business’s international transactions, finding a reliable and affordable solution is crucial. It, formerly known as TransferWise, has emerged as a leading player in the international money transfer market, offering a transparent, fast, and cost-effective way to send money worldwide.

Table of Contents

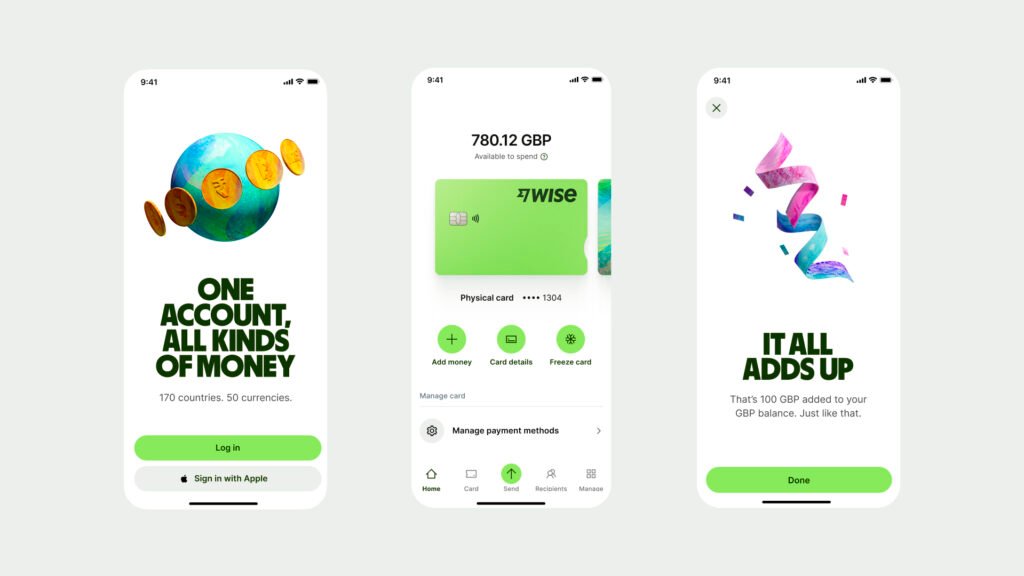

What is Wise?

It is an online money transfer service that allows individuals and businesses to send money internationally at a fraction of the cost charged by traditional banks. Founded in 2011 by Taavet Hinrikus and Kristo Käärmann, It has grown rapidly and now serves millions of customers worldwide.

How Does It Work?

It operates on a peer-to-peer model, matching users who want to send money in one currency with those who want to receive it in another. This eliminates the need for traditional currency exchange, which often comes with high fees and unfavorable exchange rates. Instead, Wise uses the real exchange rate – the one you see on Google – and charges a small, transparent fee for its services.

Key Features of It:

- Transparent Pricing: It charges a small, upfront fee that is clearly displayed before you make a transfer. There are no hidden fees or markups on the exchange rate.

- Real Exchange Rate: Wise uses the mid-market exchange rate, which is the rate you see on Google or Reuters. This ensures that you get the most accurate and fair exchange rate possible.

- Fast Transfers: Most transfers with It are completed within one to two business days, depending on the currencies involved.

- Multi-Currency Account: Wise offers a multi-currency account that allows you to hold and manage money in multiple currencies. This is especially useful for businesses that operate internationally.

- Integration with Other Services: It integrates with popular accounting software like Xero and QuickBooks, making it easy to manage your international transactions.

How to Use It:

Using Wise is simple and straightforward. Here’s how it works:

- Sign Up: Create an account on the It website or mobile app.

- Verify Your Identity: To comply with regulations, Wise may ask you to verify your identity by providing a copy of your ID or passport.

- Set Up Your Transfer: Enter the amount you want to send and the recipient’s details.

- Choose Your Payment Method: You can pay for your transfer using a bank transfer, debit card, or credit card.

- Review and Confirm: Review the details of your transfer, including the exchange rate and fees, and confirm your transaction.

- Track Your Transfer: You can track the progress of your transfer in real-time on the Wise website or app.

Why Choose Wise?

- Cost-Effective: It offers some of the lowest fees in the industry, making it an affordable option for international money transfers.

- Transparent: With It, you always know exactly how much your transfer will cost and what exchange rate you’ll receive.

- Fast: Most transfers with Wise are completed within one to two business days, so you can get your money where it needs to go quickly.

- Secure: It is regulated by financial authorities in multiple countries and uses industry-standard security measures to protect your money and personal information.

- User-Friendly: The It website and mobile app are easy to use, even for those who are not tech-savvy.

Conclusion:

It is a smart choice for anyone who needs to send money internationally. With its transparent pricing, real exchange rate, and fast transfers, It offers a cost-effective and reliable solution for individuals and businesses alike. Whether you’re sending money to family abroad, paying for goods and services, or managing your business’s international transactions, Wise makes it easy to get your money where it needs to go.